Another year of the pandemic has led to significant tax law changes for the 2021 season. Recent adjustments will affect many families’ finances, especially those with children.

Michael Parrish has a 4-year-old son. He says daycare costs are becoming a huge financial burden on their family.

“It gets to the point where it’s more expensive than like going to college,” said Parrish.

In Georgia, the average cost of infant care is over $8,500 for the year, while child care for a 4-year-old costs about $7,300, according to the Economic Policy Institute.

“Am I going to pay for his early-childhood education or pay for college?” said Parrish.

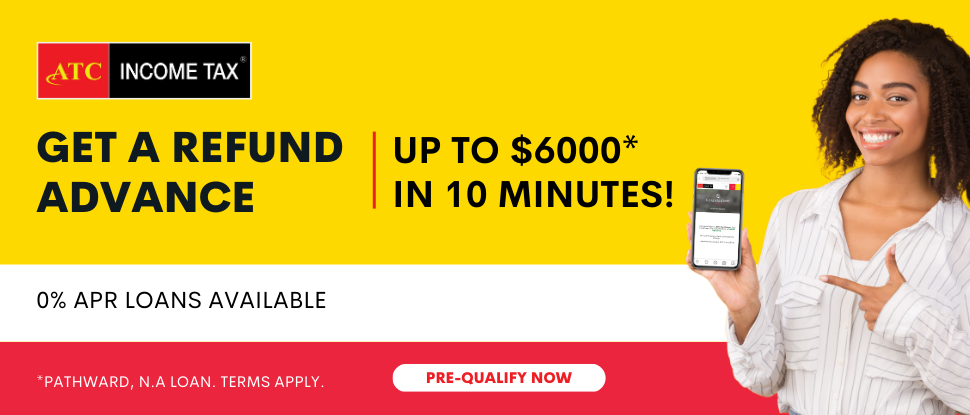

But new this year, The American Rescue Plan act has increased benefits in 2021 tax filings for families with children, including an enhanced child and dependent care credit. It’s money saved that could be spent elsewhere.

“Car payments, rent, food, vacations, taking him on trips, unexpected medical expenses, like it’s a pandemic, people get sick, and miss work,” said Parrish.

Instead of up to $3,000 in child care credit for one child, the plan allows the credit for up to $8,000 in expenses for one child and $16,000 for multiple kids for this year only, so far, based on your income bracket.

“Any increase is good,” said Parrish.

Tom Lenz, tax director at Cressett Capital, a financial consulting agency, explains.

“If you have someone who is providing daycare to your child, be it a daycare center or in-home help, you should request a form w-10 from them, which is all the information you’ll need from the childcare provider to report it on your tax return,” said Lenz.

But that’s not all. The plan signed in March by President Joe Biden, also boosted the 2021 child tax credit from $2,000 per child age 17 and under to $3,000. Children under six will also have an additional tax credit of $600.

Millions of families already received half this amount up front, through $250 or $300 monthly payments, from July through December.

“Overall they are getting more money back from the government, there just may be less in the form of a refund check but more throughout the year,” said Lenz.

Lenz also says there may be a bit of a delay with receiving your tax refund back, just like in the previous years due to the pandemic.

“There’s definitely already a backlog heading into the year, and additionally between the stimulus payments and the advance payments of the child tax credit, there’s some new stuff this year where quite frankly it’s going to be more challenging for taxpayers to complete a more accurate tax return.”

Meanwhile, for everyone, the IRS announced inflation adjustments for standard deduction for this filing year — for single; married filing separately, it’s now $12,550.

No comments